income tax registration malaysia

If this is your first time filing your taxes online there are two things that you must have before you can start. Copy of Identification Card Passport of Candidate Partners 2.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

If you want to file an income tax return employees should have a tax number and get it from the Inland Revenue Board of Malaysia IRB.

. Failure to do so. Please select Category and Year then click Search button to see the display. Visit LHDN Website LHDN website httpsedaftarhasilgovmyindividudafsgjpnvdprdphp 2.

Income tax is tax imposed on income from employment business dividends rents royalties pensions and. Register yourself as a taxpayer to LHDN and then register for e-Filing which is LHDNs. However non-residing individuals have to pay tax at a flat rate of 30.

Registration Steps 1. Additional rates will be implemented in case of special instances of income. TAX IDENTIFICATION NUMBER TIN 1 Income Tax Number ITN The Inland Revenue Board of Malaysia IRBM assigns a unique number to persons registered with the oard.

Malaysias personal income tax year is from 1 January to 31 December and income is assessed on a current year basis. This will be in effect from 2020. Copy of up to date audited account 3.

Copy of Form D The Certificate of Registration from CCM 4. File your income tax online via e-Filing 4. In this online method an employer need to directly log.

E-Daftar is a website that allows you to register online. The tax filing deadline for person not carrying on a business is by 30. Your income tax number and PIN to register for e-Filing the online.

On the First 20000. Through this online process both registering submitting monthly tax deductions in Malaysia is convenient and time saving. How to Register Submit Monthly Tax Deductions PCB in Malaysia MTD and PCB are the commonly used acronyms which stand for Monthly Tax Deductions MTD and Potongan Cukai.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Sole Proprietor and Partnership Forward the following documents together with the application form to register an income tax reference. First is to determine if you are eligible as a taxpayer 2.

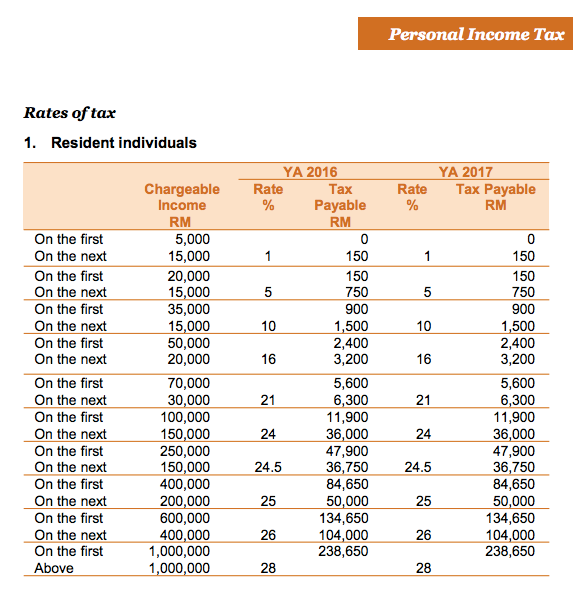

Other income received by individuals companies cooperatives associations. On the First 5000 Next 15000. On the First 5000.

The tax year in Malaysia runs from January 1st to December 31st. Calculations RM Rate TaxRM A. If your annual employment income is above that figure you will need to do two things.

Obtaining an Income Tax Number If you do not hold but require an Income Tax Number you should. Registration of companys tax file is the responsibility of the individual who managing and operating the company. Check out our step.

Verify your PCBMTD amount 5. It is a standard for employers to have. Application to register can also be made through online.

If you do not have an Income Tax Identification Number but require one you should do the following. Ensure you have your latest EA form with you 3. Where a company commenced operations.

Resident individual who carry on business with employment and other income. Download Form - Registration. Income tax shall be charged for each year of assessment upon the income of any person accruing in or derived from Malaysia or received in Malaysia from outside Malaysia.

You can get your income tax number by registering as a taxpayer on e-Daftar and you can get your PIN after that either online or by visiting a LHDN branch. Resident individual with employment income and does not carry on business. Register Online Through e-Daftar Visit the official Inland Revenue Board of Malaysia.

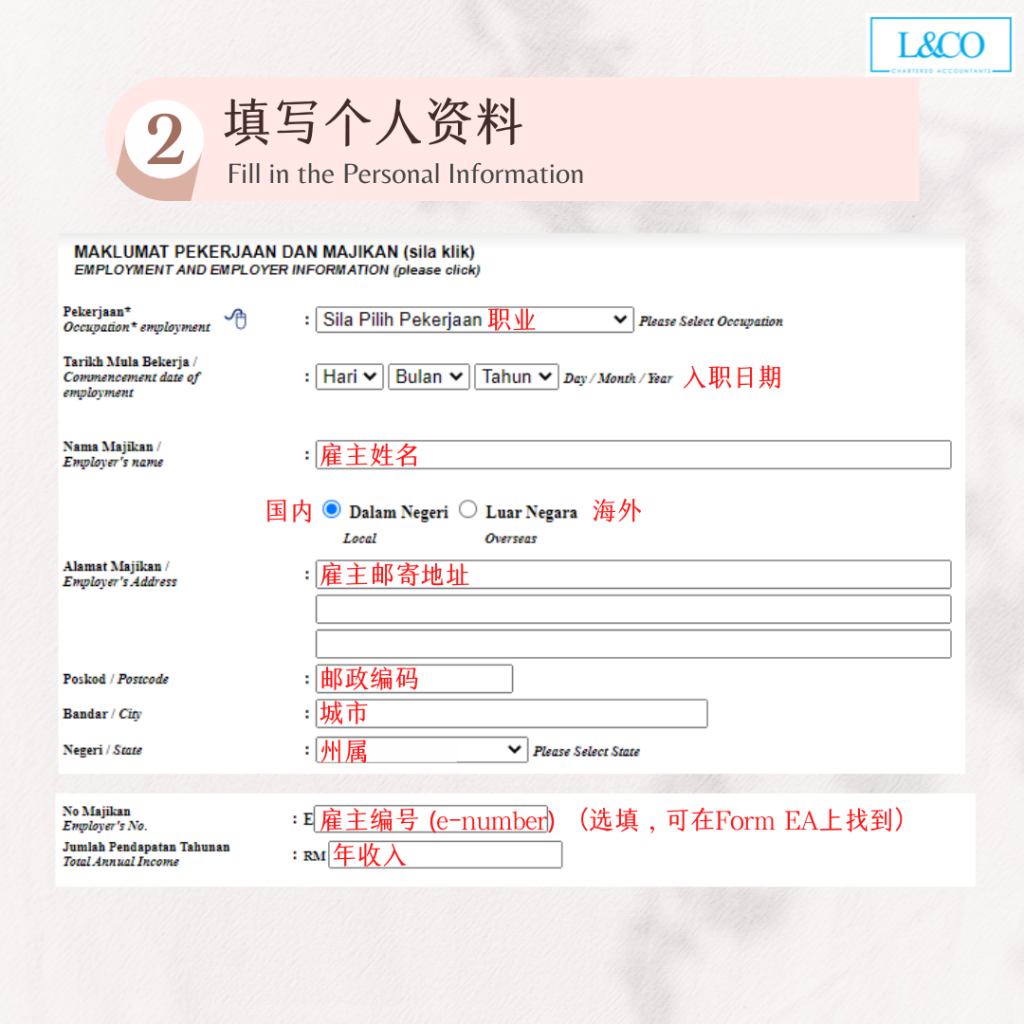

All tax residents subject to taxation need to file a tax return before April 30th the following year. Fill in the Personal Information Fill. They need to apply for.

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Ctos Lhdn E Filing Guide For Clueless Employees

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

First Time Taxpayer Registration Guide Income Tax Malaysia 2022 Youtube

A Guide To Maximize Your Income Tax Filing In 2022

How Do I Register For Tax How Do I Obtain An Income Tax Number Tax Lawyerment Knowledge Base

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Malaysia Personal Income Tax Rates Table 2012 Tax Updates Budget Business News

How To Register Tax In Malaysia

Income Tax Number Registration Steps L Co

Malaysia Personal Income Tax Guide 2020 Ya 2019

6 Differences Between Sole Proprietorship And Sdn Bhd In Malaysia Tetra Consultants

7 Tips To File Malaysian Income Tax For Beginners

The Complete Income Tax Guide 2022

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Withholding Tax On Foreign Service Providers In Malaysia

0 Response to "income tax registration malaysia"

Post a Comment